What is Staking in Crypto? An Easy Guide to Earning Passive Income

Staking in Crypto is an activity that lets people earn rewards by helping secure a blockchain. You lock up — or “stake” — coins and, in return, the network pays you a small reward. It is one of the main ways people earn passive income with staking. But like any financial choice, it has trade-offs. We’ll walk through how staking works, why networks use it, how to stake crypto coins safely, and what you can reasonably expect in rewards.

What is staking and why does it exist?

Staking is a way for some blockchains to keep their networks honest and running. In older systems, computers solved hard puzzles (mining) to add new blocks. Many modern blockchains use a different method called Proof of Stake. In short:

- People lock up tokens as a pledge that they will act honestly.

- The network chooses stakers to validate transactions.

- Honest validators get rewards; dishonest ones can lose part of their stake.

This process keeps the system secure without the large energy use of mining. It also opens a chance for everyday users to earn rewards by participating.

Two simple images to hold in your mind

Think of staking like:

- A neighborhood watch where neighbors lock a small deposit to join patrols. If they do their job, they get a share of a community fund. If they cheat, they lose their deposit.

- A savings jar that you lock for a season; while your money is locked, the jar gives you extra coins as thanks.

Both images capture the trade-off: you earn for helping, but your funds are less flexible while staked.

How staking works — step by step

Staking steps are straightforward:

- Choose a coin that supports staking (many do, like Ethereum after its upgrades, Cardano, Solana, Polkadot).

- Pick a method: run a validator node yourself, or delegate to a validator (delegation).

- Lock (stake) your coins in the chosen way. They become part of the network’s security.

- Receive staking rewards periodically, usually paid in the same token.

- To access your funds, you request unstaking; the network may impose an unbonding period (a waiting time).

The waiting time guards the network. It helps prevent sudden withdrawals that could be used to attack the blockchain.

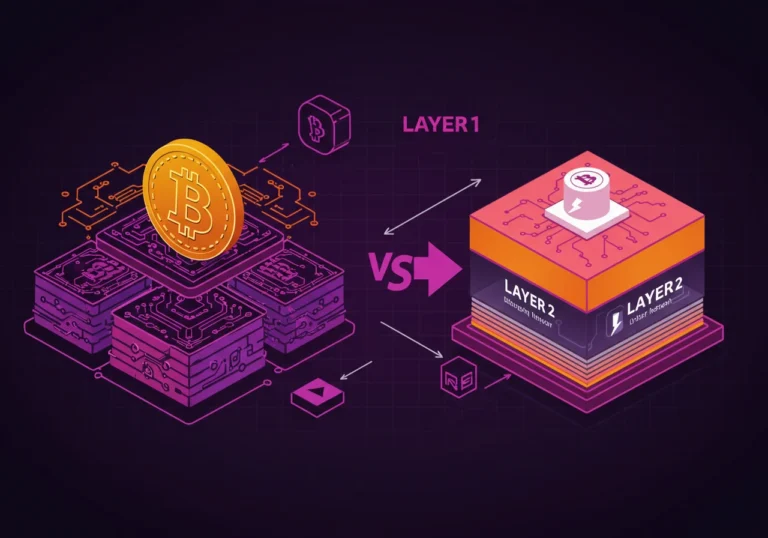

Different ways to stake: running vs. delegating

You have two main paths to stake:

- Run a validator node: This requires technical skills, a reliable computer or server, and a minimum stake size (some networks require a lot). You earn rewards directly but also handle maintenance and security.

- Delegate to a validator: You pick a trusted validator and delegate your stake. The validator does the technical work and usually takes a small commission. This is the easiest choice for most people.

Delegation opens staking to anyone with modest holdings. It’s like lending your coins to a steward who helps them work.

How much can you earn? Understanding rewards

Staking rewards vary. They depend on:

- The network’s reward rate and inflation schedule.

- How many people stake (higher participation can lower individual rewards).

- The validator’s performance and fees.

- The time your coins remain locked.

You might see annual yield ranges from a few percent to double-digit figures on some networks. But higher yields often come with more risk.

When thinking about returns, compare staking rewards to other options and factor in possible price changes of the token itself. A 10% reward looks good until the token price drops 30%.

Why staking helps networks: simple reasons

Staking supports a blockchain in practical ways:

- It secures the network by making attacks costly.

- It aligns incentives: stakers want the network to do well since their funds are at stake.

- It enables decentralized governance on some networks, where stakers vote on changes.

By staking, you play a role in keeping the system honest and useful.

Common questions about safety and risk

Staking is not risk-free. Here are the main risks to know:

- Price risk: Your staked tokens can lose market value. Rewards pay in the same token, so losses can outpace gains.

- Slashing: Some networks punish bad validator behavior by taking a portion of staked funds. Choosing a reliable validator reduces this risk.

- Lock-up / unbonding period: You may not access funds immediately when you decide to unstake.

- Counterparty risk: If you delegate, you trust the validator to act properly. Bad operators can harm your rewards or cause penalties.

- Platform risk: If you use an exchange or third-party service to stake, their security practices matter. Centralized platforms can be hacked or mismanage funds.

Understanding these risks helps you make calm decisions.

How to stake crypto coins — practical steps

If you want to start staking, here is a gentle plan:

- Learn the coin’s rules. Every network has its own unbonding periods, minimums, and fee models. Read the docs or help pages.

- Choose between self-running or delegation. Most beginners delegate.

- Pick a reputable validator. Look for high uptime, low commission, transparent team, and good community feedback.

- Use a secure wallet. Hardware wallets are best for long-term staking. Some wallets integrate staking features.

- Start small. Stake a modest amount first to learn how rewards and unbonding work.

- Monitor periodically. Check rewards and validator performance. Consider switching if your validator underperforms or acts badly.

Small, steady steps reduce mistakes and build confidence.

Staking on exchanges vs. self-custody

Some exchanges offer “staking” products. They make it easy: you deposit coins, and the exchange stakes them for you. The perks: simplicity and lower technical demands. The downsides: you lose direct control and trust the exchange to act properly. Some exchanges offer flexible staking with quick withdrawals, but those often provide lower yields.

Self-custody (staking from your own wallet or delegating to a validator) gives more control and usually higher rewards, but it requires more responsibility.

Benefits of staking tokens — why people do it

People stake for several reasons:

- Passive income: Earn regular rewards without active trading.

- Network support: Play a role in securing and governing the blockchain.

- Compounding: Reinvested rewards can compound over time.

- Lower volatility exposure: Some staking models reduce sell pressure and encourage holding.

These benefits of staking tokens make staking appealing as part of a longer-term strategy.

Practical examples — two short stories

- Anna’s small experiment: Anna staked a modest amount on a popular proof-of-stake network via delegation. She earned monthly rewards and used them to buy coffee. Watching small rewards arrive taught her patience and the value of long-term holding.

- Marco runs a node: Marco is technical and runs a validator. He earns higher gross rewards but must cover server costs and updates. When his server was down briefly, he lost some reward potential. He learned that running a node needs discipline.

Both examples show different routes and outcomes. Choose the path that fits your time and skill.

Taxes and reporting — don’t forget the rules

Staking rewards may be taxable in many countries. Tax treatment varies: rewards might count as income when received, or as capital gains when sold. Keep records of rewards, dates, and values. If you are unsure, ask a tax professional. Good record-keeping prevents surprises later.

Tools and resources for staking

Useful tools include:

- Official network explorers to see staking statistics.

- Wallets with built-in staking features for your chosen coin.

- Staking dashboards and trackers to compare rewards and validator performance.

- Community forums and the network’s documentation for up-to-date rules.

Use multiple sources to verify information and avoid mistakes.

How to choose a validator — concrete checklist

When delegating, check these items:

- Uptime: The validator should be online most of the time.

- Commission: A reasonable fee is fine; extremely high fees eat rewards.

- Reputation: Look for transparency, public team information, and community feedback.

- Security: Does the validator use secure hardware and backups?

- Reward history: Steady payouts over time are a good sign.

Taking time on this choice protects your stake.

Staking strategy ideas

- Conservative: Stake major tokens on reputable networks and keep a long-term view.

- Balanced: Split funds between staking and trading or other investments.

- Active: Learn multiple networks and re-delegate to top-performing validators, but watch fees and taxes.

Match strategy to your goals and risk tolerance.

FAQ

Q: What is the minimum amount I need to stake?

A: It depends on the network. Some have low minimums or let you pool with others; some require thousands of tokens. Check the network’s rules.

Q: How soon do I get rewards?

A: Reward schedules vary. Some networks pay daily, some weekly, some per epoch. Check the token’s documentation.

Q: Can I lose my staked coins?

A: You can lose part of your stake through slashing if a validator misbehaves. Price drops can also reduce value. Choosing trusted validators helps.

Q: Can I sell staked coins?

A: You usually must unstake and wait through an unbonding period before you can sell. Some platforms offer liquid staking tokens that represent your stake and can be traded, but they come with trade-offs.

Q: Is staking insured?

A: Not typically. Some services might offer limited protections, but most staking is uninsured. Treat it as an investment with risk.

Conclusion — is staking right for you?

Staking is a powerful way to earn passive income with crypto. For many people, it is a gentle, more predictable path compared with active trading. But it is not without risk: market swings, slashing, and lock-up periods change outcomes. Start small, learn the rules of your chosen network, pick a reliable validator, and monitor your stake. With patient steps, staking in cryptocurrency can become a steady part of a long-term financial approach.

If you want a printable checklist to start staking safely, I can create one for you.

Key takeaways

- Staking in Crypto means locking tokens to help secure a blockchain and earn rewards.

- Staking in cryptocurrency can be done by running a validator or delegating to one.

- Passive income with staking comes as token rewards, but is subject to price risk and potential penalties.

- How to stake crypto coins: choose a network, pick a validator or run a node, stake, and monitor rewards.

- Benefits of staking tokens: earn rewards, contribute to network security, and enable compounding.

- Staking rewards explained: rewards depend on network rules, participation rate, validator performance, and fees.

Table of Contents

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.