How to Use Shamir’s Secret Sharing (SSS) to Protect Your Seed Phrase

Shamir’s Secret Sharing is a smart, quiet way to protect a seed phrase. It breaks your secret into pieces so no single slip loses everything. In the next paragraphs I’ll explain how it works, how to use it step by step, and how it compares with other tools like multisig wallets.

Shamir’s Secret Sharing — what it is and why it helps

Shamir’s Secret Sharing (often shortened to SSS) is a mathematical method that splits a secret — like a wallet seed phrase — into several parts, called shares. You choose two numbers: the total number of shares n and a threshold k. Anyone who holds at least k shares can put them together and recover the secret. Owning fewer than k shares reveals nothing.

Imagine a treasure map cut into 5 pieces where any 3 pieces rejoin the map. That is exactly what SSS does, but for digital secrets. It gives you Seed Phrase Protection without having to write one phrase on many insecure pieces of paper. You can spread the shares across places or people and reduce the chance that a single loss or theft breaks everything.

Why this matters: with ordinary backup, a single lost notebook or a hacked cloud account can expose your seed phrase. SSS lowers that risk and gives you more control over who can reconstruct access.

Let’s see this example

Suppose you have a 12-word seed phrase. Using SSS you might create 5 shares and set the threshold to 3 (a 3-of-5 scheme). You keep one share at home in a safe, give another to a trusted family member, store a third in a safe deposit box, and keep the last two in different secure places. If one share is destroyed or one person becomes unavailable, you still have options.

How Shamir’s Secret Sharing works — simply

The math behind SSS uses polynomials and finite fields. You don’t need to understand that to use it safely. The core ideas:

- Choose

n(number of shares) andk(minimum shares to recover). - A program or tool converts your seed into a numerical secret.

- The tool generates

nunique shares so that anykof them can be combined to reconstruct the original seed. - Shares are stored separately and treated like partial pieces of a key: one alone is useless.

Many tools implement the method so you do not code math yourself. The important bit is picking good n and k values and safe storage practices.

Choosing n and k — the trade-offs

Picking n and k is a balance between safety and availability.

- A low threshold (k small) means easier recovery but higher risk: fewer shares required increases the chance that an attacker can gather enough.

- A high threshold (k large) means stronger protection but also a higher risk you may be unable to recover if too many shares are lost.

- Common practical setups: 2-of-3, 3-of-5, or 4-of-7. For personal use, 3-of-5 often balances safety and availability well.

Think of key people and places when choosing. If you want to involve family, choose a threshold that reflects who will reliably keep their share safe.

Practical steps: creating and using shares safely

Here’s a step-by-step, simple process you can follow.

1 — Pick a reliable tool

Choose a well-reviewed SSS tool. Look for open-source software with community audits. Avoid unknown websites that ask you to enter your seed online.

2 — Work offline when possible

Create shares on an offline, clean computer or a secure offline device. This reduces the risk of malware capturing your seed during the split.

3 — Choose n and k

Decide how many shares you want and how many are needed to recover. For many people, 3-of-5 or 2-of-4 makes sense.

4 — Generate shares and store them securely

When the tool creates shares, write them down or engrave them into metal plates. Paper can rot or burn. Metal backup kits survive more disasters.

Store each share in a separate, trusted place: a home safe, a bank safe deposit box, a secure friend’s custody, or a safety deposit facility. Keep records of where shares are stored — but do not write the locations on any share.

5 — Test recovery with a dry run

Before relying on the system, perform a recovery drill. Use k shares and restore the seed on a test wallet. Confirm you can derive the original seed and the wallet works. Then remove the restored seed from the test device.

6 — Revoke and update if needed

If a share is lost or a custodian is no longer trusted, create new shares from your original seed phrase and replace the old ones. This avoids leaving a gap open to attackers.

These steps keep your Digital Asset Backup practical and reliable.

Where to store shares — practical options and who to trust

Choosing storage is as important as splitting.

- Home safe: A fireproof safe is good for one share. Don’t store all shares together.

- Bank safe deposit box: Good for a share but check access rules (some banks restrict financial items).

- Trusted family member or lawyer: Use only if you trust them. Consider legal arrangements for estate planning.

- Security deposit services: Some companies offer distributed custody. Research reputation carefully.

- Geographic spread: Store shares in different cities or regions to protect against local disasters.

For the most sensitive situations, combine options: one share in a bank, another with an attorney, and one at home.

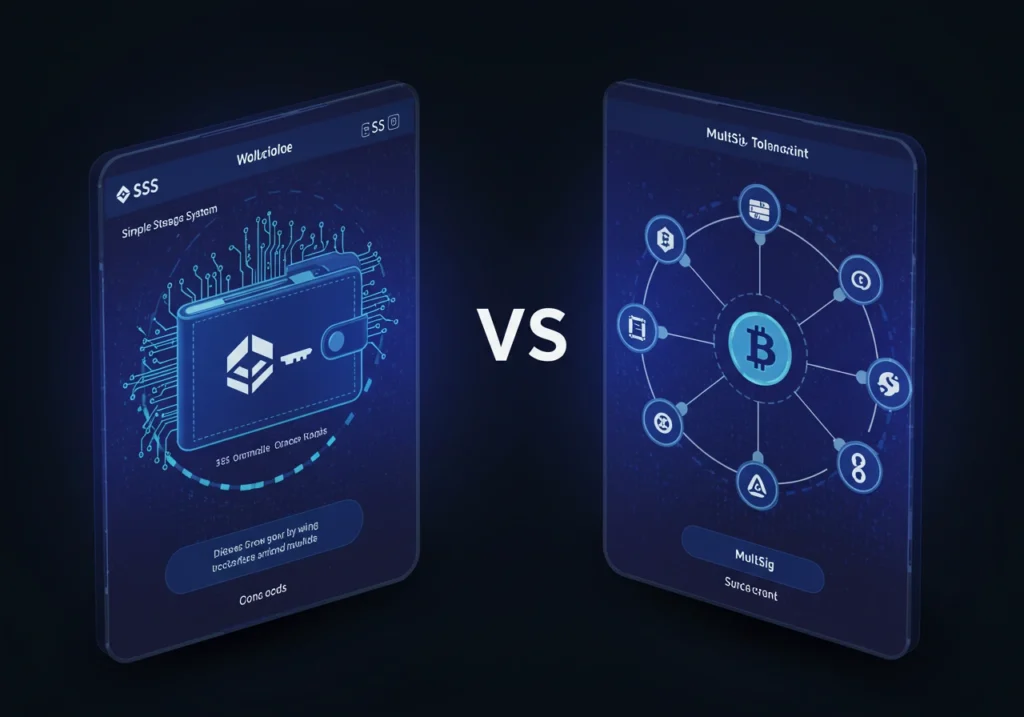

Compare with multi-signature wallets

Multi-signature wallet technology (multisig) is often mentioned alongside SSS. They solve related but different problems.

- Multisig requires multiple keys to sign a transaction. It’s ideal for ongoing access control (e.g., business wallets or family funds). Multisig is enforced at the wallet/protocol level.

- SSS protects a single seed phrase by splitting it. It’s a backup mechanism rather than a signing policy.

You can use both. For example, keep funds in a multisig wallet (so a single compromised key can’t move funds) and protect recovery seeds for the multisig keys with SSS. That combines the strengths of both approaches.

Common mistakes and how to avoid them

People make avoidable errors. Here’s how to steer clear:

- Mistake: Using untrusted online tools. Never paste your seed into random web pages. Use audited, offline tools.

- Mistake: Storing all shares in one place. That defeats the point. Spread shares widely.

- Mistake: Not testing recovery. Always run a dry recovery test before relying on the system.

- Mistake: Telling too many people. Keep knowledge minimal. Share only with trusted guardians.

- Mistake: Poor record keeping. Keep a private note of where shares are stored but store that note safely (e.g., encrypted and not with the shares).

Small habits protect more than clever tech.

Legal and estate issues — planning for the future

What happens if you pass away or become incapacitated? A plan matters.

- Write a clear, private document explaining how to find and use shares. Don’t store it with the shares.

- Consider a trusted executor or lawyer who understands crypto. They can hold one share or be the custodian of the recovery instructions.

- Think about jurisdiction: access to bank boxes and legal rules vary by country. Plan accordingly.

SSS can be part of an estate plan. It helps ensure heirs can access assets properly, without exposing everything to a single point of failure.

Tools and safety notes

Look for these features when choosing tools:

- Open-source and auditable code.

- Offline or air-gapped operation.

- Clear instructions and community reviews.

- Option to encode shares into easy formats or metal engravings.

Avoid any tool that asks for your seed in a cloud form, uploads shares to servers, or is closed-source without audits.

When not to use SSS

SSS is powerful but not always necessary.

- If you have a small amount and want the simplest route, a hardware wallet and one secure paper backup might be enough.

- If you run an ongoing business requiring many signatures, a multisig wallet may be better.

- If you cannot guarantee storage of multiple shares, SSS may complicate recovery.

Choose the method that fits your needs and commitment to safe storage.

Final thoughts — calm steps protect what matters

Shamir’s Secret Sharing gives you a gentle way to keep your seed phrase safe. It turns one fragile secret into many pieces you can spread across time and place. With a bit of care — choosing the right k and n, using secure tools, testing recovery, and storing shares wisely — you can protect your Digital Asset Backup without losing access.

This method is practical and human. You don’t need to be a coder or a lawyer. You need a calm plan, trusted places, and a recovery habit: test once, then test again. Little by little, these steps build a safety net that protects your money and your peace of mind.

Main takeaways

- Shamir’s Secret Sharing splits a seed into multiple shares; any

kofnshares can recover the seed. - Use offline, audited tools and avoid pasting your seed into unknown websites.

- Choose

nandkbased on how many custodians and locations you trust (common: 3-of-5). - Store shares in separate, secure places: home safe, bank box, trusted person.

- Test recovery before relying on your setup.

- Combine SSS with Multi-signature Wallet Technology for stronger ongoing security.

- Keep legal and estate plans current to avoid access problems after major life events.

FAQ

Q: Is Shamir’s Secret Sharing better than multisig?

A: They serve different purposes. SSS protects a secret by splitting it; multisig enforces multiple approvals for transactions. Often they are best used together.

Q: Can someone reconstruct the seed with just one share?

A: No. A single share in a properly implemented SSS scheme reveals no useful information about the full seed unless the threshold k is met.

Q: Are there trusted apps for SSS?

A: Yes—pick open-source projects with community audits. Avoid closed, unreviewed services. Consider doing the splitting on an air-gapped device.

Q: What if I lose too many shares?

A: If fewer than k shares remain, you cannot recover the seed. That is why testing and thoughtful storage are critical.

Q: How do I update shares if I need to change custodians?

A: Generate new shares from the original seed and replace the old ones. Do not attempt to modify shares—always recreate them to be safe.

Table of Contents

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.