Pump and Dump Tactics Uncovered: Keep Your Crypto Safe

A Moment That Made Me Wonder

Have you ever watched a friend get so excited about something—like a “can’t-miss” deal—that you almost jumped in too? I had a moment like that once. A guy I knew was raving about this tiny company’s stock. “It’s going up like crazy!” he said. “You’ve got to buy it now!” The price was climbing fast, and it felt like everyone was talking about it. I almost pulled out my wallet, but then I stopped. Why was it moving so fast? A week later, it crashed, and my friend lost a chunk of cash. That’s when I learned about Pump and Dump schemes. Ever had a close call like that? Let’s sit down and figure this out together—like we’re chatting over a cup of coffee.

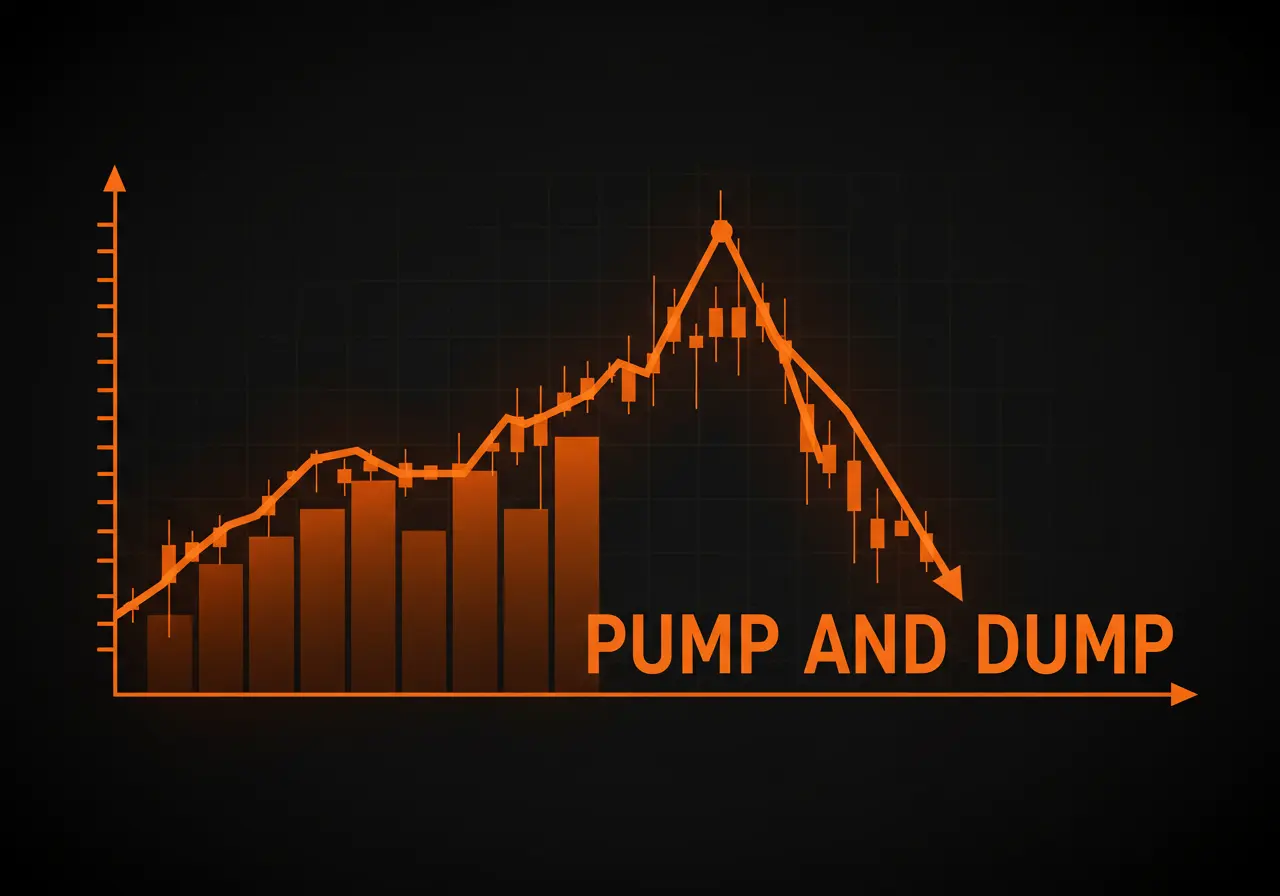

What’s a Pump and Dump Scheme Anyway?

Imagine you’re at a market, and someone’s shouting about a “magic” fruit. They say it’s the best thing ever—makes you strong, smart, you name it! They’ve got a crowd around them, all excited, buying it up. The price shoots up because everyone wants it. Then, the seller quietly slips away with a pile of cash, and the buyers find out it’s just a regular old apple—not magic at all. That’s what a Pump and Dump scheme is in the stock world. It’s a trick where people make a stock seem amazing, push the price way up, and then sell it before everyone realizes it’s not worth much.

These tricks are a type of stock market fraud. They’re not fair, and they’re against the law because they fool people into losing money. It’s like someone cheating at a game to win while you lose. Let’s break it down so it’s super clear.

How Do These Schemes Work?

Step 1: Picking Something Small

The people behind this usually pick a small, cheap stock—something not many people know about. Think of it like choosing a little toy car instead of a big truck. It’s easier to push around because not a lot of people are watching it.

Step 2: Making a Big Fuss

Next, they start talking it up. They might post on social media, send emails, or even call people, saying, “This stock is going to make you rich!” They’re like those loud salespeople yelling about that magic fruit. They want everyone to get excited and start buying.

Step 3: The Price Climbs

When lots of people buy, the stock’s price goes up fast. It looks like something big is happening—like the company’s about to do something amazing. More people see it rising and jump in, thinking they’ll make money too. It’s like a crowd rushing to grab that fruit before it’s gone.

Step 4: Selling and Running

Once the price is high, the schemers sell all their stock. They make a bunch of money because they bought it cheap and sold it expensive. This is their illicit enrichment—getting rich by tricking others. But now, the game’s almost over.

Step 5: The Big Drop

After they sell, the excitement fades. People realize there’s no real reason the stock went up—it was all fake hype. The price falls hard, like a balloon popping. Anyone who bought late ends up with falsely valued stocks—something they paid a lot for that’s now worth almost nothing.

This whole thing is an illegal trading strategy. It’s built on lies, or what some call deceptive practices, and it messes with the stock market in a fake way—creating artificial market movement. It’s not how things are supposed to work.

Why Should You Care?

You might be thinking, “This sounds sneaky, but does it really affect me?” Well, it does if you’ve got any money you want to grow—like savings for a house, a car, or just a rainy day. These schemes are a financial crime, and they hurt regular people like us. They’re part of unfair market practices that make it hard to trust the stock market. If you jump in without knowing, you could lose everything you put in. That’s why figuring this out matters—it’s about keeping your hard-earned cash safe.

Pump and Dump Schemes: Spotting the Warning Signs

Things That Should Make You Pause

So, how do you know if you’re walking into one of these traps? Here are some clues to watch for—think of them like red flags waving in front of you:

- Random Tips Out of Nowhere: Someone you don’t know messages you, saying, “Buy this stock—it’s a sure thing!” Why are they telling you? What do they get out of it?

- Promises That Sound Crazy: If they say, “This stock will triple tomorrow!”—stop and think. Does that even make sense? Real money doesn’t grow that fast.

- Pushing You to Hurry: They might say, “Act now, or you’ll miss out!” It’s like a salesperson rushing you to buy something before you can check it out. Take a breath—don’t rush.

- No Real Story: If there’s no news—like a new product or a big sale—to explain why the stock’s jumping, be careful. It might just be price manipulation.

- Tiny Companies: These tricks often happen with small, unknown stocks. Big companies like Apple or Coca-Cola? Harder to mess with.

Listen to That Little Voice

You know that feeling when something’s too perfect? Trust it. If a stock’s acting wild and you’re not sure why, step back. It’s better to wait than to lose everything.

Keeping Your Money Safe

Simple Ways to Stay Smart

Good news—you don’t have to fall for this stuff! Here’s how to protect yourself, step by easy step:

- Check It Out Yourself: Before you buy, look up the company. What do they make? Are they doing well? It’s like kicking the tires on a car before you buy it.

- Don’t Trust Everyone: If someone’s super pushy about a stock, ask, “Why should I believe you?” People might not always have your best interests at heart.

- Look at the Numbers: If a stock’s price is up but not many people are trading it, that’s weird. It could mean a few folks are faking it to trick you.

- Wait Before You Jump: Everyone’s buying? Hold on. Sometimes the crowd’s wrong—like when they all thought that fruit was magic.

- Stick to What You Know: Use places you trust for info—like big news sites—not some random tip from a stranger.

Slow Down, Win Big

Here’s a secret: growing money takes time. It’s like planting a garden—you don’t get tomatoes overnight. Chasing fast cash can land you in an investment scheme like this. Be patient, and you’ll come out ahead.

What If You Spot One?

Doing Something About It

Say you see something fishy—like a stock going wild with no reason. What can you do? You don’t have to just sit there. In the U.S., you can tell the Securities and Exchange Commission—they’re like the stock market’s watchdogs. Other places have their own groups too. Even if you’re not 100% sure, saying something can stop the tricksters.

You can also tell your friends. “Hey, watch out for this—it doesn’t add up.” The more we talk about it, the tougher it gets for these schemes to work.

Bringing It All Together

So, there you have it—Pump and Dump schemes are like a shiny trap. They look tempting, but they’re set up to take your money and run. By knowing how they work, spotting the signs, and playing it smart, you can stay out of trouble. It’s all about keeping your cash where it belongs—with you.

Investing’s supposed to help you build something, not leave you empty-handed. Next time you hear about a stock going through the roof, take a second. Ask, “Is this real, or just another trick?” You’ve got this—stay sharp, and your money’s safe.

Quick Points to Keep in Mind

- Pump and Dump is when someone fakes a stock’s value to make money and leave you with nothing.

- Watch out for random tips, big promises, and pressure to buy fast.

- Check out a company yourself before putting money in—don’t just follow the buzz.

- Small stocks with wild jumps? Could be trouble.

- Tell someone if you see something off—it helps everyone.

Table of Contents

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.