Maximal Extractable Value: The Hidden Tax on Every Transaction

Table of Contents

Maximal Extractable Value is the technical name. At its heart, MEV is about control over the order and inclusion of transactions. That control lets some parties take extra profit, often at the expense of regular users.

What is Maximal Extractable Value?

MEV is the extra profit someone can make by choosing which transactions go into a block and in what order. Think of a block like a page in a receipt book. Whoever writes the page can decide which receipts appear first. That order can change who ends up paying more or less.

In blockchains, the people who pick and order transactions are miners (in proof-of-work) or validators (in proof-of-stake). But other actors — searchers or bots — can also influence the process by sending special transactions or paying to get priority. That gives them chance to profit in ways regular users do not.

A picnic example

Imagine you and a friend both want the last sandwich at a picnic. Someone at the table decides who gets it. If they give it to your friend because your friend paid them a little under the table, that is like MEV. The chooser extracted extra value by arranging the outcome.

How MEV works

MEV shows up in a few common patterns. Here are the easiest to understand, with everyday analogies.

Front-running (like cutting in line)

Someone sees a big trade coming and quickly places their own order before it. The big trade moves the price. The front-runner then sells for a small profit. It’s like seeing someone buy all the last concert tickets and rushing ahead to buy before them to resell later.

Sandwich attacks (pinching the middle)

This is a two-step trick. A bot places one order before the victim and one right after. The victim’s trade moves the price in the middle, letting the attacker profit on both sides. Picture someone pushing in front of you to buy a toy, then pushing again after you to sell it at a higher price — all because they controlled the order.

Back-running and liquidation hunting

Some bots watch for trades that will trigger liquidations or big price shifts. They place orders right after those trades to capture profits. It’s similar to waiting for a big sale to finish, then swooping in to buy and resell immediately.

Arbitrage (finding price gaps)

Bots spot price differences across exchanges and move fast to balance them. This benefits the market overall because prices align, but it also gives those fast actors profit opportunities. When those arbitrage gains are large, they can eat into trader returns.

Who benefits from MEV?

Several groups can gain.

- Searchers: These are bots and traders that look for profitable transaction sequences. They write clever strategies to take MEV.

- Validators/miners: They can capture MEV by choosing which transactions to include.

- Builders and relays: Newer systems separate the party that builds a block from the one that proposes it. Builders can extract MEV and offer shares of profit to proposers.

The money taken by MEV often ends up with these sophisticated actors, not the average person sending a small token transfer.

Why is MEV a problem?

MEV has real-world effects beyond theory.

- It increases costs for users. MEV often shows up as worse prices or lost value in trades. That is like an invisible fee on top of gas or trading costs.

- It hurts fairness. Regular users lose out because they lack the speed or tools to compete with bots.

- It can destabilize networks. If validators chase MEV too aggressively, they might behave in ways that harm decentralization or security.

- It encourages harmful tactics. Some MEV strategies, such as chain reorgs or manipulative ordering, can damage trust.

Simple examples of MEV in action

A user placing a trade

You send a transaction to swap token A for token B. A searcher spots that your trade will move the price. They send a fast transaction that runs right before yours, buying token B. Your trade now happens at a worse price. The searcher sells later. You lost extra money — that loss is captured as MEV.

A liquidation event

A margin trader’s position gets liquidated. A bot sees this coming and places the liquidation transaction in a profitable way, capturing leftover value. The liquidation proceeds are less than they might have been, because MEV extractors got some.

What is being done about MEV?

People in the blockchain world are aware of MEV. There are practical ideas and tools that aim to reduce its harm.

Private mempools and sealed-bid auctions

Instead of broadcasting transactions publicly where bots can see them, some systems send them privately to builders or relays. This reduces front-running because attackers can’t see pending trades. Sealed-bid auctions ask searchers to submit bundles privately, and the block builder chooses the best bundle.

Fair ordering and time-based methods

Some proposals try to order transactions by the time they arrived, or randomize ordering to make manipulation harder. This works like a fair queue where cutting is penalized.

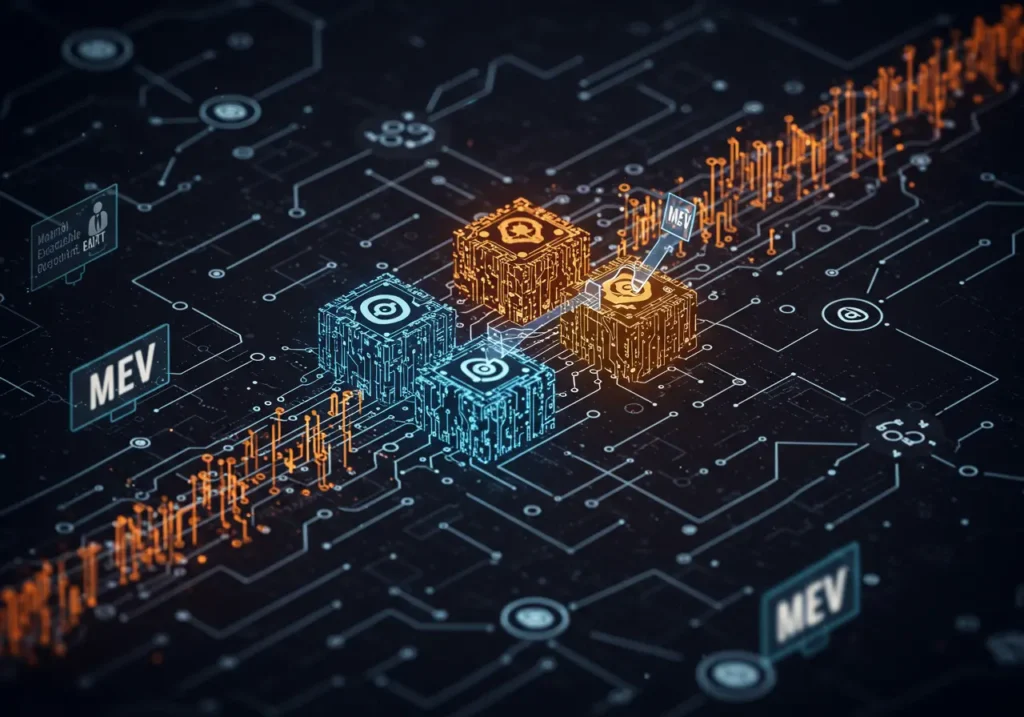

Proposer-builder separation (PBS)

This design separates the entity that builds a block (assembling transactions and extracting MEV) from the one that proposes it to the network. Builders can compete to offer validators a share of MEV. Properly set up, this can surface MEV gains and distribute them more transparently, but it can also concentrate power if not managed.

MEV-aware wallets and aggregators

Some wallets and services try to protect users by bundling transactions or using private relays. They aim to hide sensitive transactions from bots.

Protocol-level fixes

Long-term, some blockchains aim to build rules into the protocol that reduce the ability to extract MEV — for example, by limiting reorderings or changing how transactions are observed.

What you can do as a user

You don’t have to be helpless. Here are practical steps.

- Use privacy or MEV-protected relays. Some wallets offer ways to send transactions that are less visible to public bots.

- Split large trades. Instead of sending one large order, consider splitting into smaller trades or using time-weighted strategies.

- Choose analytics and tools. Use aggregators that route trades to the best pools and may protect against sandwich attacks.

- Watch gas and timing. Very low gas can leave you vulnerable to being picked off. Very high gas can make you a target. Balance matters.

- Stay informed. MEV changes fast. Follow reputable sources and projects working on mitigation.

The balance: efficiency vs. fairness

MEV isn’t all bad. Arbitrage helps markets be efficient. Some MEV strategies align prices across exchanges. The challenge is to keep the good parts while reducing the unfair, extractive actions.

Developers, researchers, and policy-makers are trying to strike that balance. The best solutions mix technical fixes, fair markets, and transparent rules.

Short conclusion

Maximal Extractable Value is an important part of blockchain reality today. It acts like a hidden tax on many transactions. Understanding MEV helps you make better choices, whether you’re a casual user, a developer, or a policymaker. The good news is that the community is working on realistic fixes. Together, technical tools and smart policies can keep blockchains efficient and fair.

Main ideas at a glance

- Maximal Extractable Value is profit taken by ordering or selecting transactions.

- MEV appears as front-running, sandwich attacks, back-running, and arbitrage.

- Searchers, validators, and builders often capture MEV.

- MEV raises costs for everyday users and can harm fairness.

- Solutions include private relays, fair ordering, proposer-builder separation, and MEV-aware wallets.

- Users can protect themselves with better tools, careful timing, and informed choices.

FAQ

Q: Is MEV illegal?

A: Not usually. MEV strategies use existing rules of blockchains. Whether a tactic is legal or unethical depends on context and local laws.

Q: Will MEV go away?

A: Unlikely. Some form of MEV will remain because transactions inherently create opportunities. The goal is to reduce harm and make extraction fairer.

Q: Are validators always bad because they extract MEV?

A: No. Validators secure networks and often return value via rewards. The issue is when MEV harms users or when extraction concentrates power.

Q: Can I use a regular wallet safely?

A: Yes — many wallets are fine for normal use. But if you do large trades or care about privacy, consider MEV-protected options.

Q: Where can I learn more?

A: Look for research and tools from reputable blockchain labs, university papers, and community projects working on MEV mitigation.

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.