Layer 2 Security Explained: How Arbitrum and Optimism Protect Your Funds.

Arbitrum and Optimism. Both networks are built to make Ethereum faster and cheaper while keeping your assets safe. In this article I’ll explain, what Layer 2 Security means, how Arbitrum and Optimism work to protect funds, the specific safety features they use, and practical habits you can use to reduce risk when using these networks.

What is a Layer 2 and why does security matter?

Think of Ethereum as a busy highway. When many people drive at the same time, traffic slows and tolls (gas fees) go up. Layer 2s are like express lanes built above the highway. They let cars move faster and pay smaller tolls, but the express lane still reports back to the main highway to make sure everyone’s trip is recorded and valid.

Layer 2 solutions such as Arbitrum and Optimism handle many transactions off the main Ethereum chain, then periodically publish summaries back to Ethereum. Because those summaries tie into Ethereum’s security, your final protections come from the main chain — that’s the core idea behind these Ethereum Layer 2 Solutions.

Security matters because when funds move off-chain or across new systems, mistakes or attacks can happen. The networks must use clear Funds Protection Mechanisms so you can trust that your money remains secure even as it moves faster and cheaper.

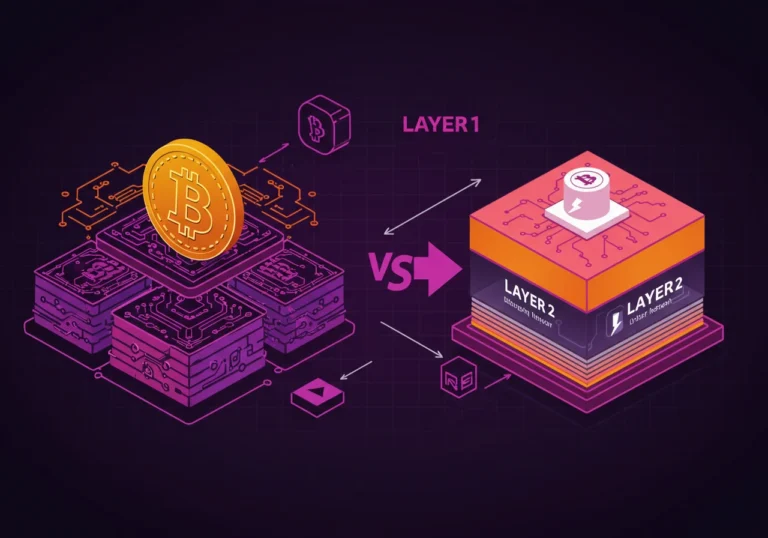

How rollups protect your money: the simple idea

Both Arbitrum and Optimism are types of rollups. A rollup collects many transactions into a single package and posts that package to Ethereum. There are two main flavors in broad terms (we’ll keep this light):

- One flavor assumes transactions are valid and lets people challenge incorrect ones (often called optimistic approaches).

- The other flavor proves transactions are valid with cryptographic proofs (called zero-knowledge in some systems).

Arbitrum and Optimism are optimistic rollups. That means transactions are assumed honest, but the systems allow challenges if something looks wrong. This balance offers faster processing with the safety net of a challenge system — one of the core Funds Protection Mechanisms they use.

Sequencers: who orders transactions and why that matters

Both networks use a component called a sequencer. The sequencer collects user transactions and puts them into the rollup bundle that goes to Ethereum. Think of the sequencer like a cashier organizing a line. The sequencer makes things fast and cheap by ordering transactions off-chain.

But ordering matters for security and fairness. If a sequencer acted badly, they could delay transactions, reorder them for profit (front-running), or refuse some transactions. To counter this, both Arbitrum and Optimism have designs and policies that reduce these risks:

- They make it possible for anyone to submit transactions if a sequencer is censoring users. That helps keep the system open.

- They rely on on-chain settlement and challenge systems so that bad behavior can be detected and corrected.

- Over time, decentralization of sequencers is planned, meaning more actors will be able to sequence transactions, which lowers the risk of a single point of control.

These structures are part of the Decentralized Finance Security picture: faster trades while preserving checks and balances.

Fraud proofs and the challenge window: the safety net

Because optimistic rollups assume transactions are valid, they must give users a way to contest fraudulent activity. That’s where fraud proofs and challenge windows come in.

When a batch of transactions is posted to Ethereum, there is a period (a “challenge window”) during which anyone can submit proof that a particular transaction was invalid. If a challenge succeeds, the system reverts the bad transaction and may penalize the attacker. This setup discourages fraud because attackers risk losing staked funds or reputation.

The presence of this challenge period is one of the main Arbitrum Layer 2 Security and Optimism Layer 2 Security features. It means that even if something suspicious appears in a rollup batch, the network and its users have time to respond and correct it.

Data availability: keeping the records honest

A key security question for any layer 2 is: can we always see the transaction data needed to re-run and verify what happened? This is called data availability. If data disappears, it becomes hard to check the correctness of transactions later.

Both Arbitrum and Optimism publish enough information on-chain so the history of transactions is available and verifiable. Because the data is anchored to Ethereum, anyone can reconstruct the state if needed. That anchoring prevents attackers from hiding transaction details.

Data availability is a quiet but crucial part of how these Ethereum Layer 2 Solutions protect your funds.

Bridges and withdrawals: moving between L1 and L2 safely

To use Arbitrum or Optimism, you typically move assets from Ethereum (layer 1) into a layer 2 through something called a bridge. Bridges are special smart contracts that lock funds on layer 1 and mint or credit them on layer 2.

Bridges are a sensitive area for security. Common protection steps include:

- Using audited bridge contracts with clear upgrade rules.

- Requiring on-chain proofs and confirmations for withdrawals.

- Implementing delay periods for withdrawals (the challenge window helps here too), so if a bad state is posted, it can be contested before funds move back to L1.

These controls are central to Funds Protection Mechanisms for transfers across chains. When you withdraw, understand that optimistic rollups usually have a withdrawal delay because of the challenge period — it’s part of the safety trade-off.

How Arbitrum and Optimism differ in their approach

Both networks aim for the same goal: cheaper, faster Ethereum transactions with strong security. But they have design choices that matter.

Arbitrum focuses on providing flexible, robust fraud-proof mechanisms and has worked to reduce complexities around transaction verification. It aims for strong scalability while keeping data available and verifiable on Ethereum.

Optimism emphasizes simplicity and standardization. It uses an architecture designed to be straightforward, making audits and verification easier. Optimism has also developed tools and practices to limit attack surfaces.

Both projects invest in audits, bug bounties, and community oversight. Those investments and transparent development practices are critical parts of Arbitrum Layer 2 Security and Optimism Layer 2 Security.

Decentralization and governance: who controls the rules?

Security also depends on who can change the system. If a small team can upgrade core contracts without checks, that’s a central point of failure. Arbitrum and Optimism work toward decentralizing control:

- They use governance systems where token holders and multisig groups participate in upgrades.

- They publish upgrade paths and timelocks, so changes aren’t sudden surprises.

- They encourage community review, audits, and public testing before big moves.

Decentralized decision-making and transparent upgrade procedures are important aspects of Decentralized Finance Security for these networks.

User-focused protections: what you can do to stay safe

Even with strong network security, good personal habits matter. Here’s a clear, practical list:

- Verify the official site and bridge link before you connect your wallet. Use bookmarks or official links from the project.

- Start with a small test transfer to confirm everything works as expected.

- Know the withdrawal times: optimistic rollups often require a waiting period for withdrawals because of the challenge window. Don’t expect instant L1 withdrawals.

- Use hardware wallets for larger balances to keep your keys offline.

- Keep your wallet and browser software up to date, and avoid unknown browser extensions.

- Watch gas fees and timing; high congestion can cause delays or higher costs.

- Check whether the project has audits and a bug bounty program. Projects that invite scrutiny are generally safer.

These are simple steps that protect you beyond the network’s built-in mechanisms.

Common risks and how the networks reduce them

Here are some typical risks and how Arbitrum and Optimism address them.

Risk: A bad sequencer hides or delays transactions.

Protection: Systems allow alternative transaction submission, and decentralization of sequencers is a long-term goal.

Risk: Fraudulent rollup batches get posted.

Protection: The challenge window and fraud proof system let honest actors contest bad batches.

Risk: Missing transaction data makes verification impossible.

Protection: Publishing adequate data on-chain ensures reconstructability and transparency.

Risk: Bridge smart contract bugs.

Protection: Audits, timelocks on upgrades, insurance funds, and careful code review reduce the chances of catastrophic bugs.

Together, these measures form the layer of protection that helps users trust their funds on these Ethereum Layer 2 Solutions.

Why withdrawals can take longer — a patient, safer system

One downside of optimistic rollups is withdrawal delays. When you ask to move funds back from layer 2 to Ethereum, the system often waits for the challenge window to pass. This is deliberate: it gives the network time to check for fraud and revert bad activity if needed.

Yes, waiting feels annoying sometimes. But that wait is a safety buffer. As the systems evolve and become more decentralized, withdrawal flows can improve while keeping protective elements intact.

Think of it like insurance: a short wait prevents a much larger, permanent loss.

Everyday analogies to make it stick

- Rollups are like batching a stack of letters instead of sending one at a time — cheaper postage overall, but each batch still gets recorded at the post office (Ethereum).

- The sequencer is like the sorter who lines up the letters. If the sorter hides a letter, others can still check the post office records and raise the alarm.

- The challenge window is like a short period where you can contest a wrongly marked parcel before it leaves the sorting center.

Table of Contents

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.