What Is DeFi? Learn the Basics of Decentralized Finance

So, What is DeFi?

DeFi, short for Decentralized Finance, is a new way of offering financial services without banks, brokers, or other middlemen. Instead, it uses blockchain technology—mainly smart contracts—to let people lend, borrow, trade, and earn interest directly with one another. Everything runs on public networks, making transactions transparent and accessible to anyone with an internet connection. In short, DeFi aims to give people more control over their money by removing the traditional gatekeepers of finance.

Think of it like a massive, bustling farmers’ market. You’ve got different stalls:

- One stall for loans (lend your spare cash, earn interest).

- Another for swapping currencies (trade your dollars for euros, digitally).

- Another just for earning on your savings.

These stalls are what we call decentralized finance platforms. You deal directly with the market’s rules (which are written in computer code!), not just one stall owner. Getting your head around how all these stalls connect and work together? That’s understanding the DeFi ecosystem. It’s the whole network buzzing along.

How Does This Magic Money Market Work?

Alright, how does money move without a bank building? It uses something called a “blockchain.” Don’t zone out! Imagine a giant Google Sheet that everyone can see, but no one can secretly change or delete a single entry. Every time someone sends money, it’s like adding a new, locked row to this sheet. Thousands of computers check it and agree, “Yep, that’s legit.” Once it’s in, it’s there forever. This builds trust without needing a bank manager. You trust the system – the code and the network watching over it.

To join this market, you need a digital “wallet.” Not leather! It’s a secure app on your phone or computer. Think of it like your own personal keychain for the market. It holds your unique digital keys:

- A public key (like your market stall number – safe to share).

- A private key (like your super secret PIN to access your stall – never, ever share this!). This wallet lets you walk up to those decentralized finance platforms – the loan stall, the swap stall – and start doing your thing.

Why All the Fuss? What’s Actually Good About DeFi?

Okay, so why bother? What are the real benefits of decentralized finance? Especially if regular banks leave you cold?

- You’re the Boss: Seriously. No asking permission. No bank deciding if you’re worthy. Got a wallet and internet? You’re in. You control your keys, you control your cash. Anytime, day or night. 24/7.

- Open Doors for Everyone: And I mean everyone. Doesn’t matter where you live, your job, or if you only have a fiver to start. Internet access? You’re good. This is huge for folks where banks are scarce or expensive. Fair dinkum access.

- Potentially Better Bang for Your Buck: Less overhead (no fancy bank buildings!), so costs can be lower. Earning interest on savings? Often beats the pants off regular banks (but hold up, risk is higher too – we’ll get to that!). Need a loan? Might find better rates lending directly to others. Sending money overseas? Usually way faster and cheaper. Cha-ching!

- See-Through System: Remember that public ledger? Most stuff happening in DeFi is out in the open. You can often peek at the rules (the code) and track where money goes. It’s a different kind of trust.

- Quick as a Flash: Sending money, especially across borders, can be minutes, not days. Loans? Approved instantly by the code, not after weeks of form-filling. Nice!

Alright, I’m Intrigued! How Do I Start?

Feeling a bit less lost? Good! How to start with DeFi isn’t as hard as it sounds, but safety is your number one priority. Let’s walk through the absolute basics:

- Learn the Ropes First (You’re Doing It!): Step zero. Seriously. Don’t just dive in. Read up (like this!), watch easy explainer videos. Knowing the basics and the dangers is your best armour. Keep building that understanding the DeFi ecosystem.

- Pick a Solid Wallet: Your gateway. For beginners, easy mobile wallets like MetaMask (works in your browser too), Trust Wallet, or Coinbase Wallet are good bets. Only download from the official app store or website! Scammers lurk everywhere online – be sharp!

- Grab Some Digital Cash (Crypto): To play in DeFi, you need digital money. Usually, Ethereum (ETH) is the go-to starting point, as many decentralized finance platforms live on its network. Buy a little ETH on a well-known exchange like Coinbase, Binance, or Kraken using your normal cash. Then, send it carefully to your own wallet address (copy-paste perfectly! Triple-check!).

- Start Tiny & Easy: Seriously, small steps. Don’t rush! Your first move could be:

- Earning a Little Interest: Look for a simple “savings” or “staking” option on a big-name, trusted DeFi platform like Aave or Compound. Deposit your ETH, earn some interest paid in more ETH or another token. Like a digital savings account run by code.

- Swapping Tokens: Use a decentralized exchange (DEX) like Uniswap or PancakeSwap. Connect your wallet, say what you have (ETH), what you want (maybe a different token), and swap! The platform finds the going rate from other folks trading. Simple as that.

- Connect with Care: When you use a DeFi platform, your wallet will ask to “connect” and approve stuff. ALWAYS double-check what you’re saying yes to! Only connect to sites you absolutely trust. And again – never, ever give out your private key or seed phrase (those backup words!). That’s like handing over your bank card and PIN to a stranger. Nope!

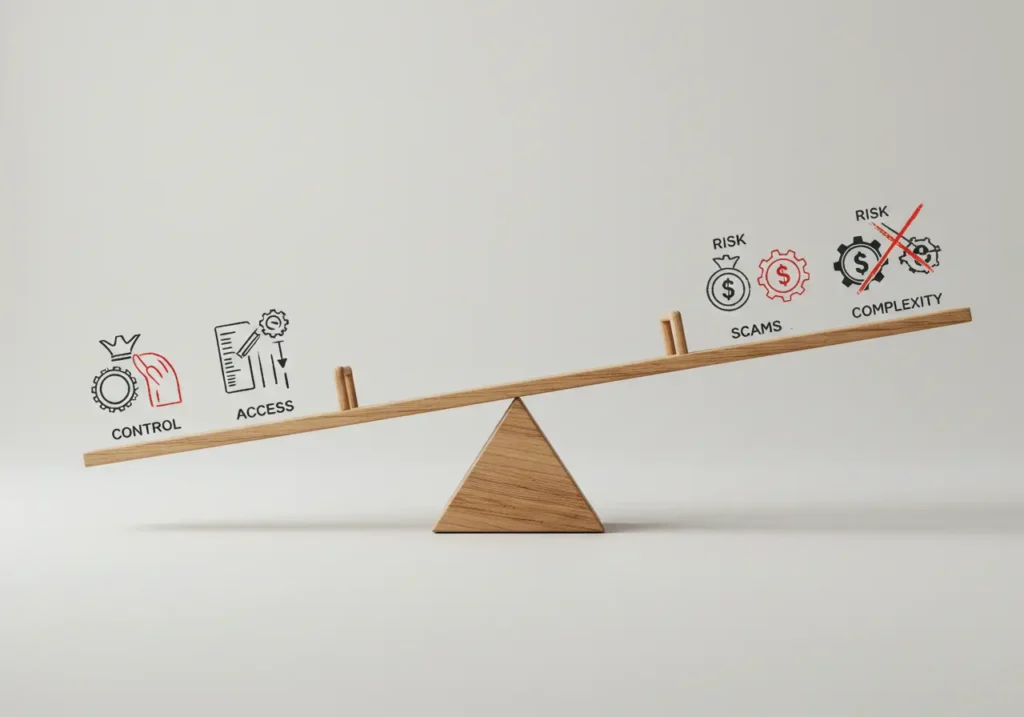

Wait a Sec… It Can’t Be All Smooth Sailing, Right? The Flip Side.

This new world is exciting, no doubt. But let’s be real – the risks in decentralized finance are serious. Ignoring them is like riding a bike downhill with no brakes. Here’s the lowdown:

- You Hold the Keys, You Carry the Risk: This is the biggest change. Forget your bank password? They can usually help. Lose your private keys or seed phrase (those 12-24 magic words)? Your money is gone. Poof. Forever. No helpline. No “manager”. Write them down on paper, stash them somewhere super safe (like a fireproof box), and never take a photo or type them online. Guard them with your life!

- Code Rules (And Code Can Break): DeFi runs on software. Software can have bugs. If a hacker finds a hole in the code of a platform you’re using… they might nick the cash. Even the well-checked ones aren’t bulletproof. It’s called “smart contract risk,” but you can just think of it as “software can glitch.”

- Scammers Galore: Sadly, new shiny things attract dodgy folks. Fake websites that look real (“phishing”), fake tokens, promises of insane returns that are too good to be true (“rug pulls” – where the creators vanish with all the money). Be suspicious! If it sounds like a dream, it probably is. Check URLs twice, research properly, and don’t let anyone rush you. Gut feeling says no? Walk away.

- Prices Can Tumble: The value of crypto and tokens used in DeFi can swing wildly. You might earn great interest, but if the token itself crashes? You could still lose money overall. It’s a rollercoaster sometimes.

- Easy to Slip Up: Sending cash to the wrong address? Approving a bad transaction? Missing a fee? Simple mistakes can cost you. Go slow. Check addresses like you’re defusing a bomb. Understand “gas fees” – the tiny payment (usually in ETH) needed to make transactions happen on the network.

So… Should You Give DeFi a Go? Let’s Figure It Out.

So, finishing our coffee, where does this leave you? DeFi isn’t a money tree. It’s got real dangers. But it is a powerful idea – a way to imagine money that’s more open, more accessible, and hands you back more control.

Is it for you? Only you can say. Ask yourself honestly:

- Can I handle the responsibility? Lose keys = lose money. Full stop.

- Can I stomach the risk? Prices jump, scams exist. It’s not for your rent money.

- Am I willing to keep learning? This isn’t “set and forget.” You gotta stay sharp.

- Am I only using cash I can afford to lose? Rule number one. Never gamble the grocery money.

If you’re nodding “yes,” and the idea of an open financial playground excites you, then dipping a careful toe into DeFi could be a wild ride and a real learning curve. Start tiny. Treat it like learning to skateboard – expect a few wobbles. Focus first on understanding the DeFi ecosystem and staying safe. Forget chasing quick riches.

The benefits of decentralized finance – openness, access, potential for better returns, you being in charge – are genuinely game-changing. But they walk hand-in-hand with the risks in decentralized finance. How to start with DeFi? It begins right here: learning, going slow, and putting safety first. Remember that feeling of holding your own coins? DeFi offers a digital version of that control, but with grown-up responsibilities. It might not be for everyone, but it’s a fascinating new world being built. Knowing about it, even if you just watch from the sidelines, is smart. Keep exploring, stay safe, and trust your gut!

Quick Recap: Your DeFi Cheat Sheet

- DeFi: Doing money stuff online without big banks or middlemen.

- Blockchain: A super-secure, public digital record book everyone trusts.

- Wallet: Your secure app for holding digital keys. Guard your private key/seed phrase!

- Decentralized Finance Platforms: The “stalls” in the DeFi market (like Aave, Uniswap) for loans, swaps, savings.

- Understanding the DeFi Ecosystem: How wallets, blockchain, platforms, and digital money all connect.

- Key Perks: You’re in control, open to all, potentially better deals/faster/cheaper, see-through system.

- How to Start: 1) Learn! 2) Get a secure wallet. 3) Buy a tiny bit of crypto (like ETH). 4) Start small & simple (e.g., earn interest). 5) Connect carefully & double-check EVERYTHING.

- Big Risks: Lost keys = lost money. Software bugs/hacks. Scams everywhere. Prices can crash. Easy to make costly mistakes.

- Golden Rule: Only use money you can afford to lose completely. Start small. Safety first, always.

Table of Contents

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.