Coinbase Brings On-Chain DEX Trading Into Its U.S. App — A Big Step Toward “Everything” in Crypto

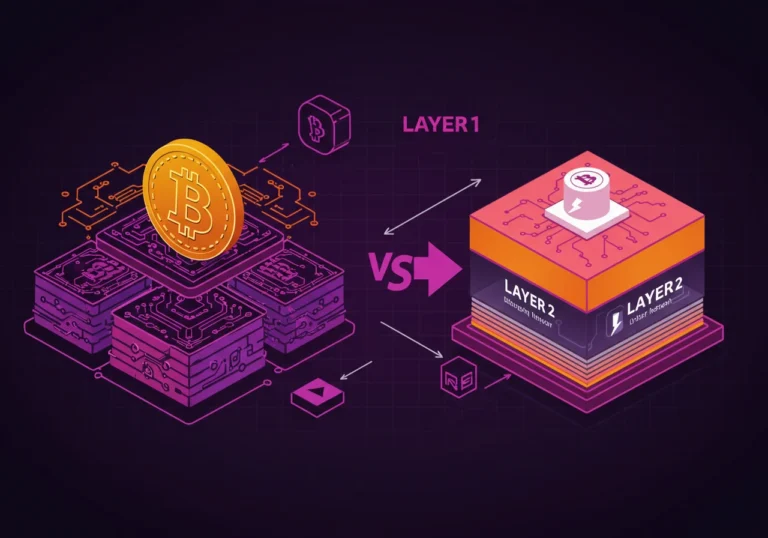

Coinbase quietly flipped a big switch this week: many U.S. users can now swap tokens on decentralized exchanges without leaving the Coinbase app. It sounds small, but this change stitches together two worlds that have often been kept apart — the convenience of a centralized exchange and the on-chain openness of decentralized trading.

At launch the feature focuses on tokens native to Coinbase’s Base Layer-2 and other on-chain markets, and it routes trades through well-known DEX aggregators and venues so users get competitive prices and broad liquidity. Coinbase will even cover network fees for users in the rollout period, and the company says the experience uses an integrated self-custody wallet so trades settle on-chain. The rollout excludes New York State for now as regulators continue to sort local rules.

This is more than a product tweak. It’s a statement of strategy: Coinbase wants to be an “everything app.” That means listing, custody, on-chain swaps, discovery, and a smoother path from fiat to DeFi — inside one familiar app. For users, it promises faster access to new tokens and fewer steps. For the industry, it is another sign that centralized players are embracing decentralization — at least at the UX level.

What actually changed for users

Before this, many U.S. customers who wanted to trade newly launched tokens or tapped-into DeFi had to move assets between platforms or use separate wallets and bridges. Now, Coinbase’s app can spawn an embedded self-custody wallet session, route a swap to a DEX (often via an aggregator like 0x or 1inch), and settle the trade on-chain — all while the user stays inside Coinbase and can even use their USD or USDC balance to fund the swap.

Operationally, Coinbase partners with liquidity sources such as Uniswap and Aerodrome (especially for Base-native projects) and uses aggregator logic to find the best route. That helps avoid fragmented order books and gives users prices closer to professional on-chain traders. It also lets Coinbase list tokens practically the moment they launch on Base, which accelerates discovery for users.

Why some people cheer — and others frown

This feature makes crypto less fiddly. For new users, that matters a lot: fewer manual transfers, fewer confusing wallet setups, and fewer steps to reach new tokens. For builders on Base and related chains, it’s a distribution channel: launch on Base, and hundreds of thousands of Coinbase users can find your token immediately. That can jump-start projects and liquidity.

But it also raises eyebrow-raising questions. Routing DEX trades from a centralized app blurs lines about custody and control. Even if trades settle on-chain into a self-custodial session, the ease of the flow can lull users into treating DEX swaps like regular exchange trades — and that changes their risk model. There’s also the regulatory wrinkle: Coinbase is expanding on-chain access while remaining under the gaze of U.S. regulators, making the legal and compliance map more complicated.

Short-term market effects

Within hours of the announcement, tokens native to Base and some newly listed projects saw notable volume spikes. Traders tested the new rails, and some smaller projects saw brief price pops as liquidity was tapped through Coinbase’s on-ramp. For active DeFi users, the ability to route trades via major aggregators from a single app reduced friction and tightened spreads on certain pairs.

On a structural level, centralized venues widening into on-chain aggregation may reduce the liquidity premium that previously sat with large DEX LPs. That matters for short windows of high volatility, where having multiple routing options can mitigate slippage and price impact.

The security trade-offs — plain language

This is where your guard goes up, and rightly so. The new flow is clever, but it doesn’t remove the long-standing risks of DeFi:

- Phishing & fake tokens: New token launches are prime targets for spoofed contracts and malicious clones. Inside an app, a misleading token name can still fool people.

- Approval fatigue: Swapping often requires approving token allowances. Auto-approval flows or rushed clicks can leave lingering permissions that attackers exploit.

- Smart-contract risk: DEXs and aggregators can carry bugs. Routing through them multiplies the code you implicitly trust.

- Custody confusion: Even with in-app self-custody, users may not fully grasp who holds private keys at each moment of the flow. That misunderstanding creates vulnerability.

In short: convenience does not eliminate risk — it only shifts its shape. Tools that make swaps easy must be paired with education and safer defaults.

How to use the new feature without getting burned (practical steps)

- Pause before you approve. Read the contract summary. If anything looks off, cancel.

- Check token addresses. Look up the official token contract on project channels or verified explorers before swapping.

- Limit allowances. Use “exact amount” approvals when possible or revoke allowances after trades.

- Use small test trades. Especially for new tokens, send a tiny amount first to confirm routing and settlement.

- Keep keys safe. Treat any on-chain, self-custody session as real custody — back up seeds, use hardware wallets where supported.

- Monitor activity. If your wallet shows strange approvals or unexpected outgoing txs, revoke and move funds to cold storage.

(These steps draw on common best practices in DeFi and wallet security.)

What this move might mean next

Coinbase’s DEX integration is a nudge toward a blended future: centralized UX, decentralized settlement. Expect competitors to follow. Expect faster token launches on L2s like Base and perhaps accelerated tooling for safer in-app custody. Expect debates between policy makers, exchanges, and developers about what “custody” really means when an app intermediates DEX access.

Longer term, the winner will be the ecosystem that combines good UX with strong, defaults-on safety — and clear, honest education for users about tradeoffs.

Bottom line: Coinbase has made it easier than ever to reach on-chain markets from a familiar app. That’s progress. But the convenience comes with old DeFi risks wrapped in new packaging. If you trade this way, be slow with approvals, check the contract, and treat every in-app swap like an on-chain transaction — because it is.

Table of Contents

Hello, I’m Edmilson Dias, founder of CoinBringer. I created this platform to guide people through the fast-moving world of cryptocurrency with clarity and safety. With years of research in blockchain and digital security, my goal is to translate complex topics into practical knowledge, offering reliable tutorials, safety insights, and guidance for both newcomers and experienced users.

Discover more from CoinBringer

Subscribe to get the latest posts sent to your email.